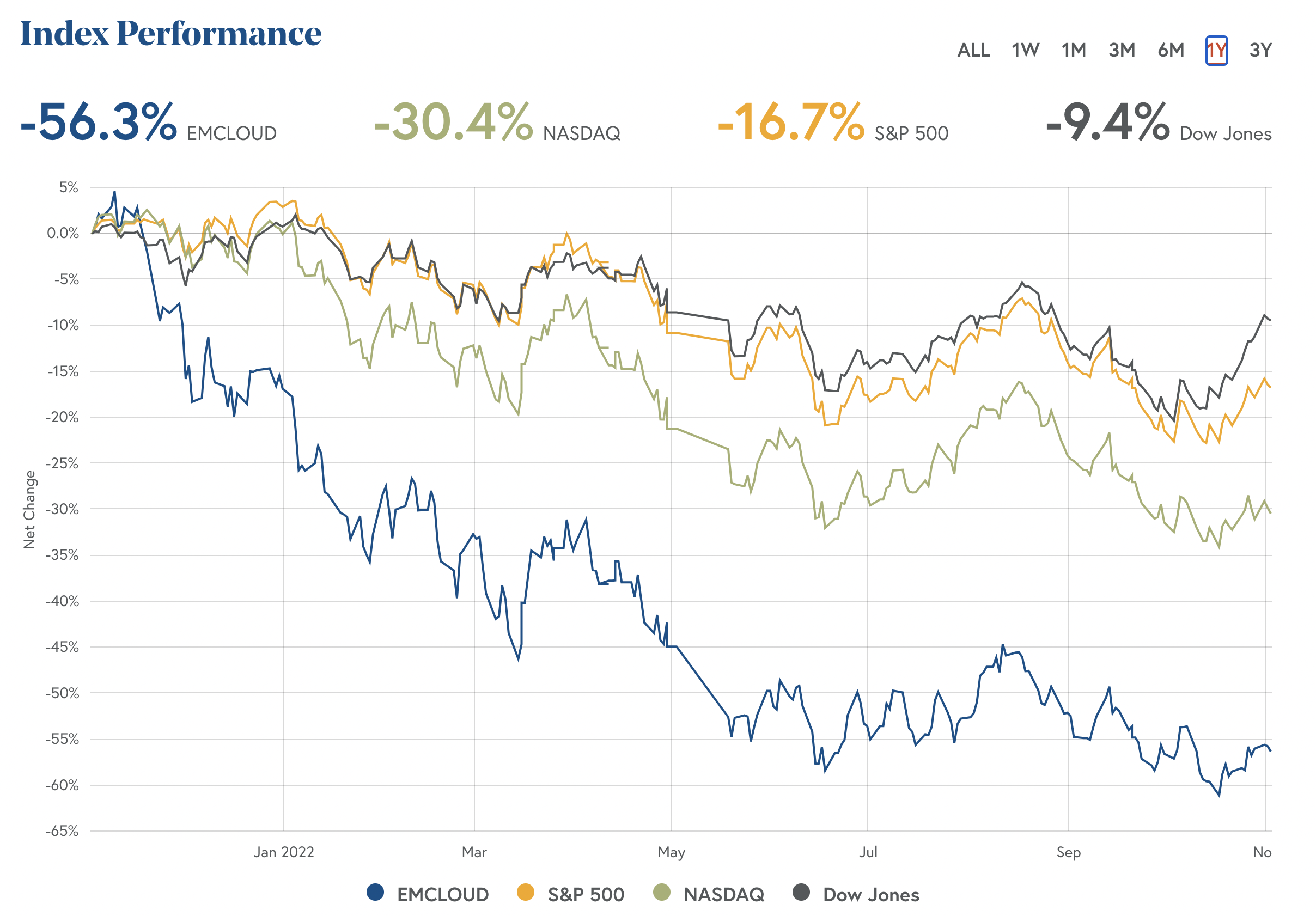

We’re heading into choppy waters. The BVP Nasdaq emerging cloud index, Emcloud, is down 56% in the last year, compared to 30% for Nasdaq overall. The median revenue growth rate for the companies in the index has dipped below 30%.

The Accel 2022 Euroscape report paints an equally gloomy outlook. Revenue multiples for public SaaS companies are down from 17x last year to below 6x, lower than a 10-year pre-Covid average. And in the private market, funding fell by 42% in Q3.

Rajesh Jain has sailed into many a storm in his 25-year journey of building Netcore Cloud, a full-stack marketing automation company serving over 6500 customers globally. It’s in a rarefied club of SaaS companies bootstrapped to $100 million ARR from India, and its founder has always placed profitability and sustainability above chasing valuations and funding. So we asked Jain for his thoughts on navigating the stormy weather ahead for companies targeting the world’s biggest market for cloud software, as rising inflation and interest rates inexorably push the US towards a recession.

The Netcore Cloud founder, who made a strong commitment to the US market this year with a $100-million acquisition of Unbxd, expects the waters to get choppier in the next 12-15 months. At the same time, he takes heart from the fundamentals of the SaaS model being as sound as ever, or even stronger, as migration to the cloud for greater efficiency and lower costs gathers momentum in hard times. “The contours of the SaaS business are such that once you have product-market fit, you can get good scale; once customers come in, the LTV (life-time value) tends to be much longer than in the B2C world.”

Nevertheless, the market conditions and investor sentiments are a siren call for prudence. “We haven’t seen a prolonged period of capital being hard to get. We saw a little bit of that in the pandemic, but the recovery was V-shaped because we knew it was an artificially induced crash. This time it’s more fundamental,” says Jain in an interview with SaaSBOOMi.

“The easy money (we saw last year) is gone and won’t come back any time soon. Investors are more discerning in the parameters for making their bets.”

The BVP Nasdaq Emerging Cloud Index performance for the last one year

Hang On To The Capital

On the positive side, SaaS companies in India raised an unprecedented amount of capital in the last two years before the funding winter set in. Last year’s rebound from the pandemic brought $4.8 billion in funding for the SaaS sector, three times the 2020 level, and the first two quarters this year surpassed 2021 levels. Research firm Venture Intelligence reported $2 billion in funding for SaaS startups in India in the first quarter of 2022.

A lot of this money is still lying in company coffers, and Jain’s advice to founders is to hang on to it. “If you raised capital at a 15x multiple, and if your business has not grown fast enough, you are going to look at a down round soon, which will be painful. So I think every entrepreneur, regardless of which stage they are in, has to think hard about their path to profitability. Can you become profitable with the existing capital you have without having to raise a new round? Because then you can call the shots on valuation and terms. Otherwise, you’re going to be in trouble.”

Jain’s cautionary note comes from first-hand experience. He admits getting sucked into overspending in 2007-08 in a bid for faster growth. And that was right before the 2008 financial crisis led to a recession.

“My lesson was never to take expenses to a level where there is a disconnect with how you think revenues are going to grow.”

It’s a similar situation now as the funding exuberance of the last couple of years cools off. It’s hard to change tack in step with the switch in momentum.

“Once you start burning cash, it’s very painful to roll it back. You tend to become inward-focused because you have to think about which team has to be shrunk, and that has its own impact on morale. So in tough times, which we’re going to see in the next 12 months, the biggest challenge is that the entrepreneur’s time gets spent on cutting costs or raising capital. Whereas, for a growing company, time has to be spent with customers, product, and engineering,” says Jain.

What then is the path forward for founders who slipped into high cash burn last year and are now trying to ride out a crunch?

“Two things are important in this situation,” says Jain. “Founders should have more capital than they think they will use because buyers are going to take longer to make decisions. So you need the extra runway for early-stage companies. You have to assume sales will take 50-100 percent more time.”

“Secondly, you need to be cautious on the cost side and find a faster path to profitability.”

“When you next raise capital, your new investors are definitely going to ask how soon you’re going to be profitable.”

The previous ones may not have asked, but the next ones will ask. So if you can show that you will make money in a reasonable length of time, it will help you negotiate from a better position. Otherwise, you may still be able to raise capital but it will likely be a down round.”

Bootstrapping to $100 million ARR

Rajesh Jain’s own philosophy as an entrepreneur from the very outset has been: “The best growth capital is your own profit because you don’t depend on anybody else.”

He put that into practice with his first venture itself, although he did try to raise funding initially for IndiaWorld back in 1996 when venture capital was virtually non-existent for Indian startups. He now recalls the experience with some amusement.

“I met one of the largest corporations in Silicon Valley who were planning to invest. The CFO of this company, after the initial small talk, asked, ‘Where are your five-year projections?’ And I said, ‘Look, I don’t run the business on five-year projections. For me, this business is life and death, OK? There is nothing else I do. You tell me the numbers you want, and I will fill out your forms for year 1, 2, 3, and so on’…

“Of course, the meeting ended five minutes after that. They did not invest. But, in a way, my failure to raise capital became a strength for me, because I had to be profitable.”

Jain ran IndiaWorld with its profits as well as the savings he had from his work in the US earlier, until he sold it to Satyam Infoway in 1999 for around $115 million. That provided substantial seed money for his next venture, Netcore. But he carried over the bootstrapped mindset for building it.

He admits that Netcore lost out to an extent by delaying its foray into the US market, unlike others who went there with VC money. But he’s happy with the path he chose.

“I had the freedom to make my own choices. I was not dependent on someone from outside telling me what to do… Being profitable, we did not lay off anybody or reduce salaries in crises. We could put our people first and not investors’ money.”

His firm belief is that you build a more lasting business model when you’re driven by the need to be profitable. “The ease of availability of capital, actually, harms entrepreneurs at an early stage, because there’s pressure from a VC to show appreciating valuation,” he says.

“You make different choices when you’re profitable. You know that one stupid mistake can mean you fail. So you have to think a lot harder, and spend a lot more time focusing on the product and customer and market.”

Netcore’s own journey of making pivots or expanding into new markets has always relied on its own accruals. This included the $100-million acquisition of Unbxd to expand in the US market and prepare for an IPO. “We used the profits accumulated over a number of years to do the large acquisition, which gave us a lot of US customers and a very good complementary line of products. We could not have done that easily in any other way. We would have needed N number of conversations with investors to give them justification (if we were VC-funded),” says Jain. “I told our Group CEO, Kalpit Jain, if you believe in it, go ahead. Just a few of us in the room made the call and went ahead.”

Also read Part 2: Rajesh Jain’s three keys to unlocking the US market

[In this, he shares insights on going to the US, building for the local or global market first, and more.]