India could be on the cusp of unlocking a $1 trillion opportunity for SaaS companies, creating nearly half a million new jobs by 2030, according to the “Shaping India’s SaaS Landscape” report released today by SaaSBoomi, Asia’s largest community of SaaS (Software-as-a-Service) founders and product builders.

In 2015, a small group of startup founders and product builders started SaaSBoomi, a community to share learnings in an open and transparent manner with other SaaS startups in the country.

In the past six years, SaaS has grown into a global business and Indian SaaS companies have simultaneously grown as mainstream players.

However, in many ways, this is only the beginning. What are the opportunities for SaaS in general over the next decade and for Indian SaaS startups in specific to stake a claim in the new normal? Are we on the Bright path? What challenges need to be overcome as a community to realize our full potential?

We adopted a disciplined approach to think through these aspects and worked on our analyses for many months to answer these questions in an objective and actionable manner.

I am delighted to share a comprehensive report addressing these issues and setting up the challenges for the sector. We are confident that this fact-base will help Indian startups get a handle on the state of SaaS as it stands today and its potential reach over the next decade.

Key findings – An opportunity knocks

Our research shows that the global SaaS sector experienced unprecedented growth over the past year, as companies, universities and governments scrambled towards digital transformation in order to make their products and services available online and conduct business remotely during Covid-19.

Software, including SaaS, now comprises $600 billion of the $3 trillion global enterprise IT and communications spending market. But with an 8% annual growth rate, its upward trajectory is almost twice the pace of the overall market. Should this remarkable growth continue, the SaaS market is expected to be worth about $1.3 trillion by 2030.

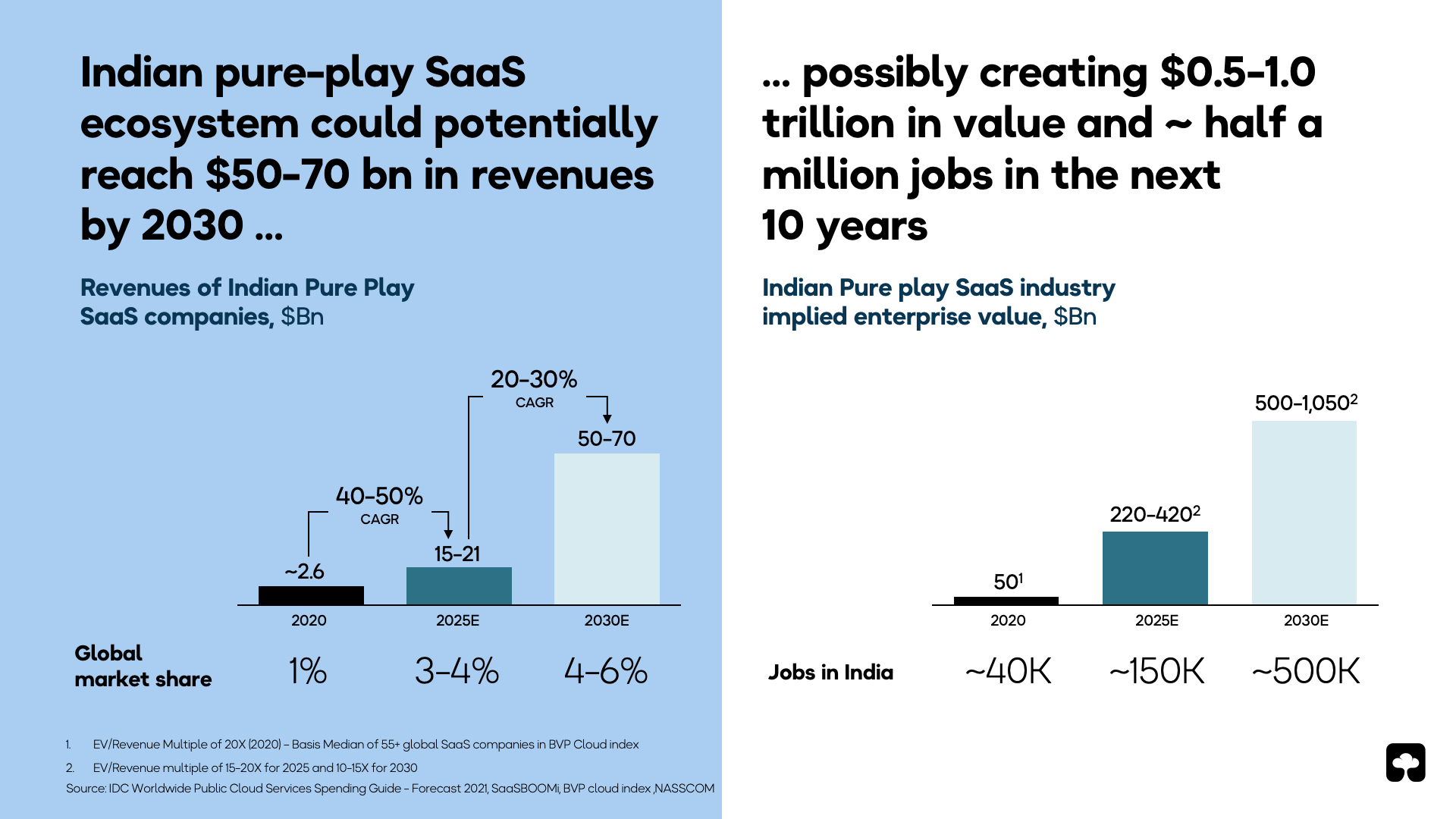

Indian SaaS companies have leveraged these tailwinds to reach new heights in terms of both scale and scope in this period. There are nearly one thousand funded SaaS companies in India, ten of them are valued at over a $1 billion to achieve unicorn status. The startups now generate $2-3 billion in total revenues and employ nearly 40,000 people.

According to our findings, if Indian SaaS providers can execute to their full potential, they could potentially generate annual revenues of $50-$70 billion by 2030 and win 4-6% of the global SaaS market. This represents a value-creation opportunity up to $1 trillion.

Today, 55-60% of global IT and operations workflows are delivered from India, which hosts 3 million developers, the world’s largest pool. This deep talent pool and our right legacy of IT services bestows us with a strong foundation to target untapped potential in new segments. We see these markets are “India’s right to win”. Beyond our affinity to horizontal SaaS solutions, vertical SaaS and developer tools are two large sectors that lend themselves well to India’s strengths.

Vertical specific software needs deep domain expertise that our IT professionals have in spades. As the world moves from legacy on-premise software to SaaS, this opens up a large new vector for Indian companies to target. Today, SaaS accounts for 35% of the overall software pie but is poised to take a much larger slice over the next decade. Indian vertical SaaS startups such as Zenoti have already reached unicorn status and there are a number of other promising companies set to follow this lead.

The other segment in which we have a beachhead advantage is developer tools and system infrastructure. Our large pool of developers not only gives us a ready domestic market, it also endows us with a deep understanding and an intimate first-hand experience of the problems to be solved. The pandemic has accelerated the shift to remote selling and the developer tools market lends itself very well to product-led growth motions that Indian SaaS companies can excel at as companies such as BrowserStack and Postman have already demonstrated.

While these opportunities beckon, all stakeholders including startups, VCs, and ecosystem enablers, would need to work together to achieve these milestones.

Scale matters for startup growth

The biggest requirement for Indian SaaS startups would be to adopt a “growth-first” mindset. To reach the $ 1 trillion milestone, the Indian pure-play SaaS ecosystem needs to be six times larger than it is now. The report highlights five key areas where SaaS companies could improve to scale the industry.

They need a razor-sharp focus on underpenetrated target domains, more powerful go-to-market strategies, an engine that continuously identifies and scales new businesses, more product differentiation and velocity, and a better and scaled-up talent pipeline.

The report also shows that Indian SaaS companies are underinvesting in their go-to-market efforts: those with revenues under $5 million spend only about 25% of revenues on GTM compared to 80-90% spent by global leaders. Underinvestment may be causing Indian companies to miss important growth opportunities. Companies would need to learn to prioritize scale and long-term market leadership over near-term profitability and invest at the level of global peers in go-to-market and product

Need for more investment especially for seed and early-stage SaaS startups

Investments are rising in the Indian SaaS industry, reaching about $1.5 billion in venture capital funding in 2020, but India would need to triple or quadruple funding to achieve its full potential. Specifically, there has to be an increased outlay for seed/early-stage companies – currently, this is only 25% of the total $1.5 billion invested in 2020 – the shape of this pyramid needs to change with this slice being much bigger.

All stakeholders working in tandem to realize the Indian SaaS ecosystem’s full potential

To thrive in the disruptions likely to play out in the next five years, the entire industry would need concerted and coordinated actions. Industry associations such as SaaSBoomi and NASSCOM, investors, corporate enterprises and the government could work together with startups to create an overarching entrepreneur-friendly environment that will help India emerge as a clear winner in SaaS.

India has an exciting opportunity to be on the world stage as a SaaS force to be reckoned with. While there are challenges ahead, these are not insurmountable. We believe that the Indian SaaS community is well-placed to build on a strong foundation to make SaaS a pre-eminent industry that is a huge value creator contributing meaningfully to India’s GDP in terms of both revenue and employment.

In many ways, this is our trillion-dollar tryst with destiny and we are determined to meet it by creating massive world-class products and platforms.

About the “Shaping India’s SaaS Landscape” Report

Anchored by Manav Garg, the founder and CEO of Eka, and aided by inputs from leading SaaS founders, VCs, and ecosystem enablers, “Shaping India’s SaaS Landscape” is a comprehensive report that captures and synthesizes information from over 40 Indian SaaS startups to throw light on the growth of SaaS startups in India, their growth potential, the Indian ecosystem’s role in it, and what these SaaS startups need to do to capture a greater share of the global market.

This report was developed by SaaSBoomi, which led a comprehensive two-month effort to build a perspective on the future of the SaaS landscape in India. McKinsey & Company as the knowledge partner helped with independent third-party research and analysis. NASSCOM as the supporting partner assisted with community outreach and expert analysis.

We are thankful for the support, guidance, and dedication of the SaaSBoomi Steering Committee and SaaSBoomi member companies. In particular, we would like to acknowledge the contributions of Girish Mathrubootham, Krish Subramanian, Mohit Bhatnagar, Sangeeta Gupta, and Shekhar Kirani. We would also like to thank Eight Roads, Sequoia, Nexus Venture Partners, B Capital Group, Accel Partners, Westbridge Capital, Tiger Global, and Microsoft for their valuable input.

A special acknowledgment is due to Avinash Raghava and the entire SaaSBoomi team for their efforts and contributions.

Special thanks

We would like to thank the following participants and founders for their valuable inputs and insights:

- Aakash Tulsani – B Capital

- Abhinav Asthana – Postman

- Anand Jain – Clevertap

- Aneesh Reddy – Capillary

- Arpit Maheshwari – Stellaris

- Ashwini Asokan – MadStreetDen

- Bhanu Chopra – Rategain

- Dev Khare – LightSpeed

- Dhruvil Sanghvi – Loginext

- Monish Darda – iCertis

- Pallav Nadhani – Charts.com

- Prayank Swaroop – Accel

- Praval Singh – Zoho

- Rajaraman Santhanam – Chargebee

- Rohit Chennamaneni – Darwinbox

- Rishit Desai – Westbridge Capital

- Sanjay Nath – Blume

- Shweta Bhatia – EightRoads

- Sparsh Gupta – Wingify

- Suresh Sambandam – Kissflow

- Sudheer Koneru – Zenoti

- Varun Shoor – Ex-Kayako

- Yamini Bhat – Vymo

And to 40+ Indian SaaS founders/ CEOs who participated in the SaaSradar benchmarking survey as part of this effort