Black Swan Bingo

If Covid and the financial market reset weren’t enough, the run on Silicon Valley Bank (SVB) last week was a sure sign that “Black Swan” events are no longer as unpredictable as one might have imagined a few years back. It almost seems that facing existential threats on a daily basis is now commonplace for every startup founder.

For Indian SaaS founders, the SVB meltdown was particularly dangerous. A large number of Indian SaaS companies are either headquartered in the US or bank through SVB in any case due to the tradition of most tech VCs having close ties with the bank and routing funding through this channel. It, therefore, came as no surprise that more than 600 Indian SaaS companies faced the grim prospect of over USD 2 billion stuck in SVB.

Though a solution, fortunately, emerged quicker than most folks could have predicted, Indian SaaS businesses face grim prospects for the next 12-18 months. Given the fact that most Indian SaaS solutions target small and medium businesses as their target market, the looming recession is likely to hit them hardest as this sector is particularly sensitive to recessionary pressures.

The spin-off impact of drastically lower spending on tech applications by the SMB market will hit Indian SaaS companies hard. This coupled with funding winter means Indian SaaS companies face a double whammy – lower access to capital coupled with lower revenue.

However, amidst this grim prognosis, there is a silver lining.

The long-term view of SaaS remains intact and firmly bullish. If software is eating the world, SaaS is eating software and will progressively increase its share of the overall tech spending pie. Indian SaaS is expected to generate revenues of $50-70 billion by 2030, a sharp uptick from just $7 billion in 2022.

The key question is what Indian SaaS founders need to do in the short term to capitalize on the opportunity for the long term.

This is the answer that the SaaSBOOMi Annual SaaS Report 2023 seeks to provide – a set of informed and actionable insights that will serve as a practical guide for navigating the rough seas ahead.

Key takeaways from the report

The report highlights that the primary requirement for SaaS founders today is to adopt a strategy that allows for both defense and offense plays. The defense aspects are in reaction to the sharp slowdown expected in tech and software budgets for the next 12-18 months and in line with this overarching “conservative and conservation” philosophy, SaaS startups need to offer productivity improvements to their customers through the optimal use of hyper-automation.

These defensive moves should constitute at least 40-55% of the overall toolkit while a smaller slide of 20-25% can be reserved for offense plays such as garnering revenue through new offerings such as “generative AI” that has a buzz and therefore meaningful interest from customers at the current time.

Overall, the report offers three key takeaways for Indian SaaS founders.

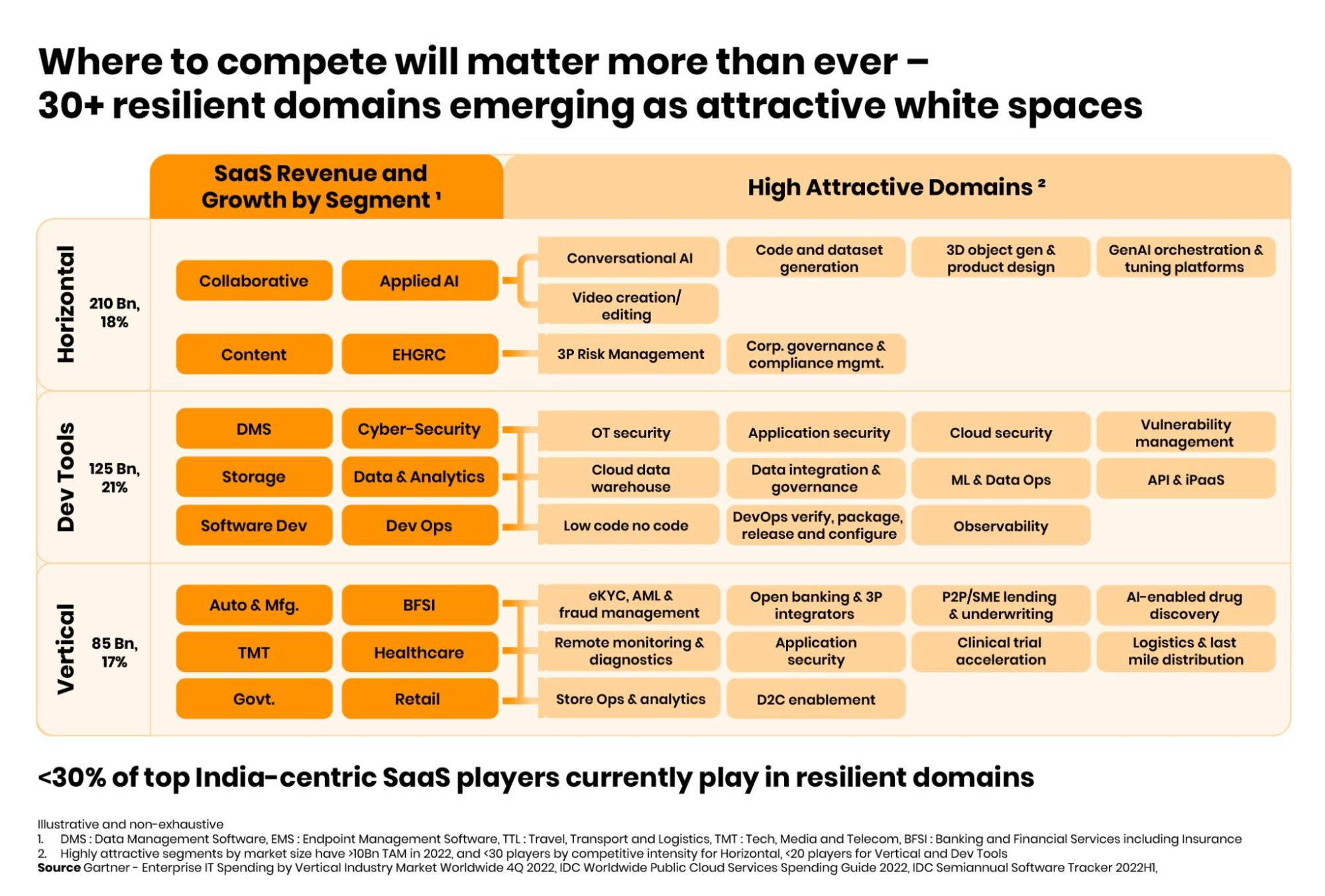

1. “Where to play” – Choose your market carefully

While it is still early days for SaaS in terms of future potential, it bears remembering that the SaaS story is well over a decade old. The nascent years of SaaS presented a number of greenfield opportunities for early players to build scalable businesses in every category – from horizontal SaaS to developer-focused offerings and from tools to vertical SaaS. However, today almost every single niche is a “red ocean” with multiple competitors jostling for the same piece of the pie.

Indian SaaS companies must therefore choose their market carefully paying attention to

“resilient domains” that offer attractive white spaces to play in. The report lays out over 30 such resilient domains for Indian SaaS companies to focus on.

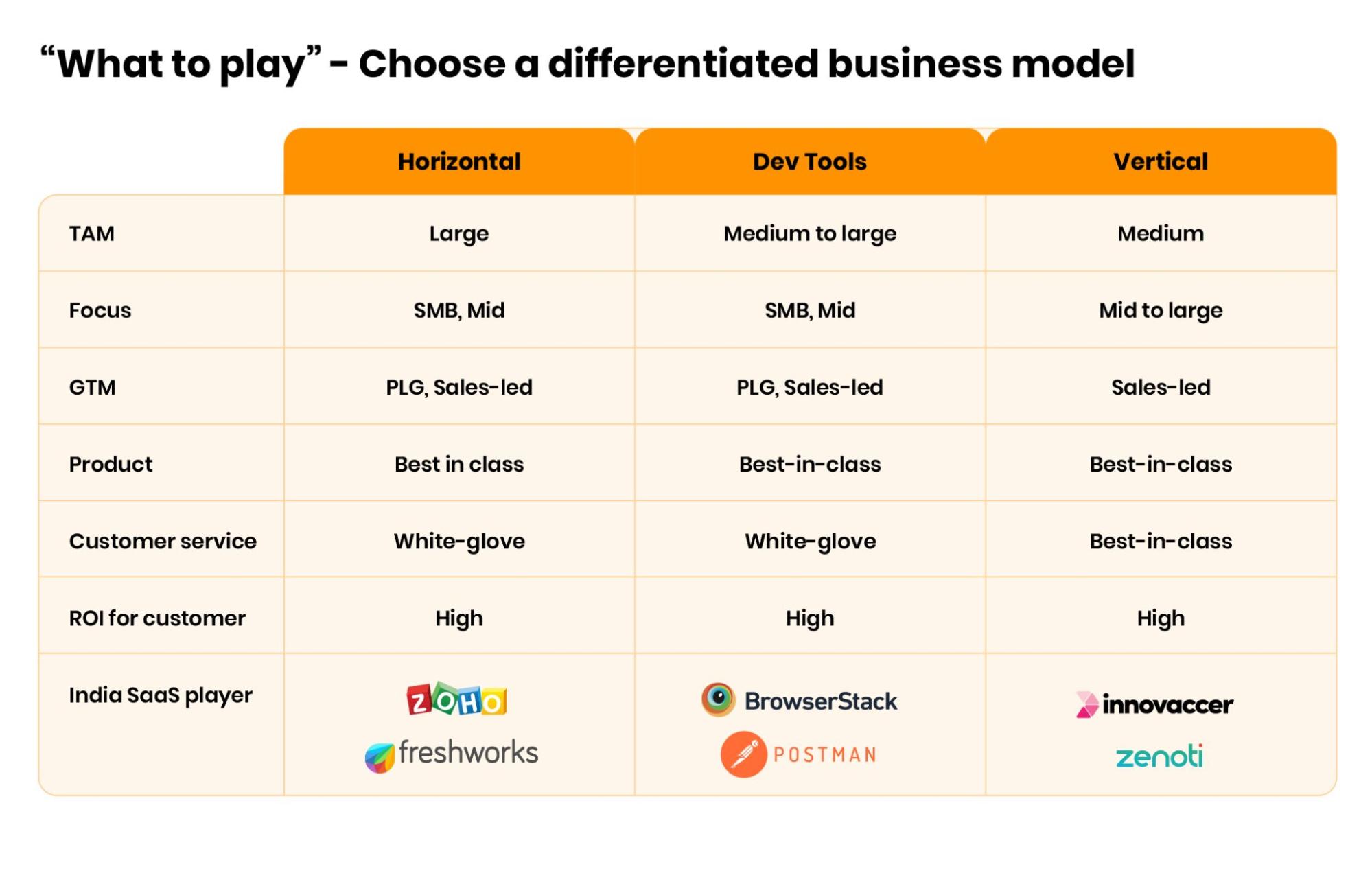

2. “What to play” – Choose a differentiated business model

The second leg is choosing what game to play in terms of business models.

Historically, Indian SaaS companies have experienced considerable business value across the entire spectrum of SaaS thus far. A simple map of the landscape can be summarized below:

This matrix allows us to glean some interesting patterns.

- Horizontal – Leveraging PLG motion in GTM: Most of the successful startups that have emerged from India, the likes of Zoho, Freshworks, Browserstack, and Postman, that have achieved meaningful scale did so leveraging product-led growth (PLG) as their primary GTM motion. Subsequently, they layered on a second engine to expand their market reach – typically, this seems to be a sales-led approach targeting the mid-market.

- Multi-product offerings: Another significant insight from this table is that the scaled startups are all multi-product companies offering an entire portfolio of products, each of which is best-in-class by itself. This double engine of growth and differentiation is a key requirement for PLG motions to succeed at scale.

- Use talent arbitrage to provide superior customer service: All these companies have also successfully leveraged the talent cost arbitrage advantage to provide superior customer service to their clients. However, this seems to have made a difference only to SMB and mid-size markets thus far and enterprise sales is still a largely untapped market segment.

Despite the success of Indian SaaS in multiple segments, one aspect that still remains elusive is SaaS players who have been successful as “category creators” – while there is some nascent promise here, there is still a long way to go.

Finally, it is clear that vertical SaaS offerings that focus sharply on a specific industry or domain continue to remain attractive – even though these startups grow more slowly relative to the other categories, they can be highly profitable.

Reading these tea leaves gives other Indian SaaS startups a roadmap to choosing their own business models and go-to-market playbooks.

3. “How to play” – shift focus from hustle to institutional execution

While there is justifiable confidence and bullishness about Indian SaaS, there is an elephant in the room that is often glossed over.

Indian SaaS companies are adept at garnering early success – many players have shown the ability to attract early customers but in a majority of cases, growth starts tapering off with scale. This is evident in the “bulging middle class” of players in the Indian SaaS ecosystem that are seemingly stuck in the $5-10m ARR category and seem unable to scale beyond.

While some of these companies may be stuck because of poor PMF beyond early adopters or small market sizes, it has been observed that a big determinant of achieving maturity lies in the “execution mindset”.

While we celebrate “jugaad” or Indian hustle – scrappy Indian startups fighting well above their weights to get off the ground – this mindset doesn’t serve them well when it comes to the post-PMF scale.

This requires an institutionalized execution mindset where efficiency and performance are achieved in a regimented and systematic manner. Here are a few aspects that Indian SaaS players need to adopt to achieve an “institutional mindset”:

Invest in go-to-market as early as possible to achieve repeatability of sales success in a predictable manner rather than treat GTM as an afterthought.

Thoughtful organization design that ensures that there are “right” persons in the “right roles. Many of us in India have not yet seen executives in mature roles so we don’t know what a successful executive looks like. Equally, our talent pools for GTM and product disciplines are not as deep as those in other mature markets. We need to consciously fill this shortcoming at an industry-wide level.

Finally, an institutionalized mindset requires companies to invest in the right tools as they scale and perceive these as investments that will offer ROI rather than as optional expenses. These tools need to be scaled with customer data in parallel to offer a comprehensive and informed view of the state of the business and a clear plan for success.

The fact of the matter is that even after making all the above investments, Indian companies enjoy a structural advantage that permits them to realistically target a score of 60% on the “rule of 40” – something that foreign players will struggle to achieve.

Despite the challenges facing the Indian SaaS industry, we are fortunate to have a vibrant ecosystem and witness growth across the board. Indian SaaS founders should use their cash judiciously, evaluate initiatives in the company, stay close to their market and customers, and build for the future. With these strategies in place, India can expect to see over 100 $100M revenue companies by 2030 – helping us achieve our trillion-dollar tryst with destiny.

Let us go and build.

I’d like to thank our knowledge partners — McKinsey & Company.