PCs, the Internet, and Smartphones all changed how work is done, and expanded the TAM for software to nearly $1Tn. Today, AI rapidly expands the TAM for software from productivity enhancement to the work itself, opening up a TAM that’s over $10Tn. This will lead to new types of business models like cloud-led to SaaS, or the internet-led to social media companies. We believe AI-led services – a strong technology product with humans in the loop – will dramatically change how services are delivered. Many of these will be built in the coming decade, and disrupt the services industry!

What is work and what is software? Traditionally, work is human effort toward creating a good or service that someone pays for. Now, humans use various tools to increase the efficiency of this work. A weaver might have started with a thread and needle, and then used a spool or handloom to produce more, before using a mechanical loom after the industrial revolution, massively increasing their productivity. Software is another such tool – an accountant used to manually take notes and do calculations, and now leverages software to do the same work faster.

Today, software is a tool to enhance productivity, but with AI models, softwa®e will do the work. What happens when a model can do most of the work of an accountant, lawyer, or doctor? It changes the market for software to the market for “work.”

Salesforce helps account executives manage their workflow (~$100bn market for CRMs), but an AI sales agent could do the selling (10-20x the TAM), Genisys helps run contact centers ($40Bn TAM) but an AI support bot can resolve queries (>$300Bn TAM), Excel helps analysts create models but an AI financial analyst could just do it, and so on. Nearly $300Bn is spent on SaaS while $2Tn+ is spent on outsourced digital work (only work that’s on a computer/phone, and being conservative) and a multiple of that is spent on payroll for internal employees doing this work.

There are a few ways founders are going after this opportunity, a) SaaS companies adding agents or modules to do the work (e.g. Replit Agent, Intercom’s AI agent), b) AI agent companies offering full stack agents (e.g. Cognition Labs’ Devin, Retell AI for voice calls) and, c) AI Services offering full stack services with humans in the loop.

We’re going to talk about the third category today since it’s a new beast for the venture ecosystem, and we believe that while we get closer to automation a large number of services will require human vetting or augmentation for the foreseeable future. It’s also an area where India’s going to have a big advantage in building high-impact companies. India has a massive talent pool for services, and a history of high-quality outsourcing, which creates a big advantage in building these from India for the world.

So what do these AI Services companies look like?

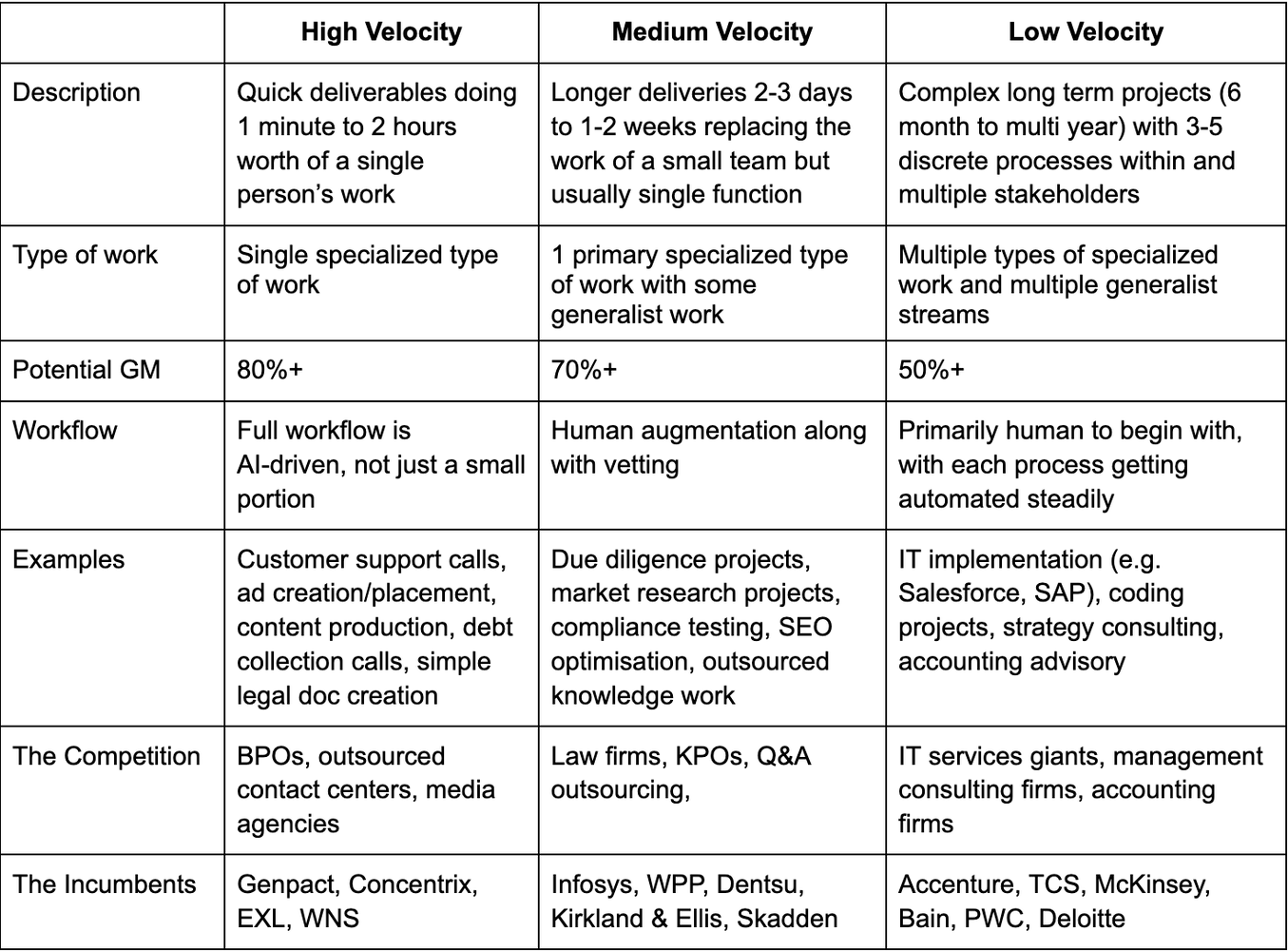

A useful categorization is by the length of the service delivered.

While high-velocity services seem like the obvious choice, this category is also most at risk for full software automation with agents/vertical SaaS so some complexity or human requirement (maybe even regulatory) might be beneficial.

Some more questions to think about as you build an AI services business.

Can you create a feedback loop?

If the work you’re doing is repetitive, discrete, and measurable (e.g. a phone call or a social media ad) you can clearly show that your outputs are better than or as good as human outputs making it way easier to win deals. At the same time, if you are getting a stream of reliable data points (e.g. NPS on a phone call, ROAS on an ad) you can iterate and improve your model rapidly creating a sustainable edge and a data moat.

Can you open up new demand?

When you make something 10x cheaper, you go beyond existing spend and open up a much larger market. For example, call centers require large contracts worth $100K+ to sign up. Imagine a 15-store dentist chain that couldn’t afford this – can they now use an AI contact center with a few humans to offer 24/7 phone support?

If you make something 10x faster and change a low-velocity service to a high-velocity service, you also open up new demand and use cases. Imagine a market research firm that turns around a 500-user survey in a week because AI callers can do calls in parallel vs a person calling sequentially, and then 500 hours of recordings can be synthesized by AI in hours instead of weeks of reading through notes. This is now a 2-day project instead of a 3-week project. Even ignoring the 10x cost advantage, won’t a consumer goods company now run a lot more market surveys?

How do you win? Build for better outcomes + create a technology platform

An interesting observation from multiple companies was that while cost matters, quality, and speed are often the real USPs that AI enables. Every enterprise cares about cost but rarely will take risks on a new vendor providing core services for cost saving.

This is also not a one-time calculus. You also need to keep winning as AI keeps getting better. Competition is coming at you from both ends – agencies adopting AI tools, and AI agents getting better and better. Building a tech platform that compounds your advantage and integrates into workflows is essential instead of just humans + off the-shelf AI tools.

Hypothetically you could build an AI Services business is a high gross margin, 10x speed improvement, better quality than humans, a feedback loop leading to defensibility, and a massive market. But there are many challenges as well.

What about competition? Aim for even larger markets and focus on defensibility

While SaaS is increasingly competitive, in AI services the competitive set is even larger – internal employees, outsourcing giants, multiple agencies big and small, and even freelancers, not to mention vertical SaaS companies and AI agent startups. Every service provider has access to the latest and greatest AI tools online such as ChatGPT, MidJourney, and more. Given you’re providing a work outcome the potential to differentiate may be lower. What this means is to build a massive business the bar on the size of the problem to go after should be larger than for a SaaS business.

You also need to be laser-focused on how to be better than agencies with AI tools. If you are easy to rip out and replace, you’ll see your GRR drop as competition rises. Try to create a data moat, or build workflows that are deeply ingrained in internal processes, or create custom models for harder problems.

It’s tempting to go broad but focus on a specific use case

A decision that’s harder as a services business is – how focussed should you be? Most large service businesses provide multiple services and go after multiple verticals of customers. It’s also extremely tempting to get a wide variety of customers and do whatever they ask for. while this is true for SaaS, it’s easier here since it’s throwing AI + people at a problem. But focus is important – breadth might help get to $1m ARR faster, but could make getting to $10m ARR tougher as you move from founder-led GTM to a repeatable playbook. Moreover, it’ll be harder to build data and quality moats.

So should you build Infosys or Accenture 2.0?

Saying we’re building Infosys or Accenture 2.0 sounds snappy, but the truth is more nuanced than that. AI is definitely a wedge to build a new IT services giant but saying ChatGPT can code so IT services margins should be 90% is too simplistic.

In reality, an IT project consists of 5-to 6 major parts from analysis and design, software development, testing, deployment, and change management. Pure software development is at most 30% of a project, and even if you could use AI to quarter the human hours on development, your overall margin improvement is 20%. This is a hard sell when you’re competing as a new player for a multi-million dollar 5-year contract where risk accumulates and there is little incentive to take a bet on a new player vs established giants. Additionally, remember IT services businesses are also tech-forward (at least compared to say law firms or BPOs), and are rapidly implementing LLMs themselves.

You can still build it, but you need to be aggressive on GTM and have the ability to convert that initial margin advantage + AI dream into real revenue, and then increasingly improve margin across the various components of projects aggressively while building a delivery organization.

A sharper approach could be picking one component of say QA and doing a 10x better job in that, before expanding. And then 10 years later, an IT services business is mostly just a consulting company doing strategy and sales, and using 6 different AI services businesses underneath to deliver a project. Or, it’s just GPT 8 🙂

This is going to be a massive disruption, and we’ll see many world changing businesses in the coming months

Let’s look at customer support for a second. There are nearly 20 million contact center agents, with over $300Bn in spend. Today’s demos are nearly capable enough of solving the vast majority of contact center queries. Theoretically, call centers should not exist a few years later, nor should a large number of repetitive, low-creativity jobs. Of course, the real world sometimes changes slower for example, even today nearly 70% of call centers don’t run on the cloud. However, the dramatic changes from AI seem to be catalyzing change at a pace that’s just way faster than the cloud cycle, so we’re in for a few years of accelerated change, which is the best time to build a disruptive company!

We don’t know the exact path, but we know that the world of work and services will look drastically different 10 years from now. And these times of dramatic change are the best times to build world-changing companies.

This post was originally published on LinkedIn.