Welcome to another episode of Deep Dive! Suresh, our host, and Aditya Tulsian, our guest, delve into the critical role of ICPs and how organizations deal with acquisition journeys.

Aditya is a seasoned entrepreneur who founded Numberz, which was acquired by Chargebee, prior to which he held a very important role at Intuit. After an MBA at ISB Hyderabad, launching QuickBooks in India was the experience that revealed a universal truth to him: businesses worry about cash flow, not accounting. In 2016, inspired by these insights, Aditya co-founded Numberz, initially for Indian small businesses, later expanding globally. The company recently got acquired by Chargebee, uniting visionary forces.

In the world of startups, understanding the Ideal Customer Profile (ICP) is like holding the compass that guides the business. The success, failure, or struggles of any company can be traced back to the clarity or confusion they have about the ICP. Aditya and Suresh nail down what it takes to find your perfect ICP, and the struggles and pressures of navigating an acquisition conversation with both the buyer and the team.

Getting started with finding your ICP – problem first or person first?

Finding the right ICP and making that clear to the company can be a bit of a challenge. You could approach it with the problem you want to solve with your business, or with the person you want to solve it for.

Drawing from experiences at Intuit, Numberz, and currently at Chargebee, Aditya claims that the Uber-level problem always takes higher priority over the person. In the words of billionaire Scott Cook, “Go broad to go narrow”.

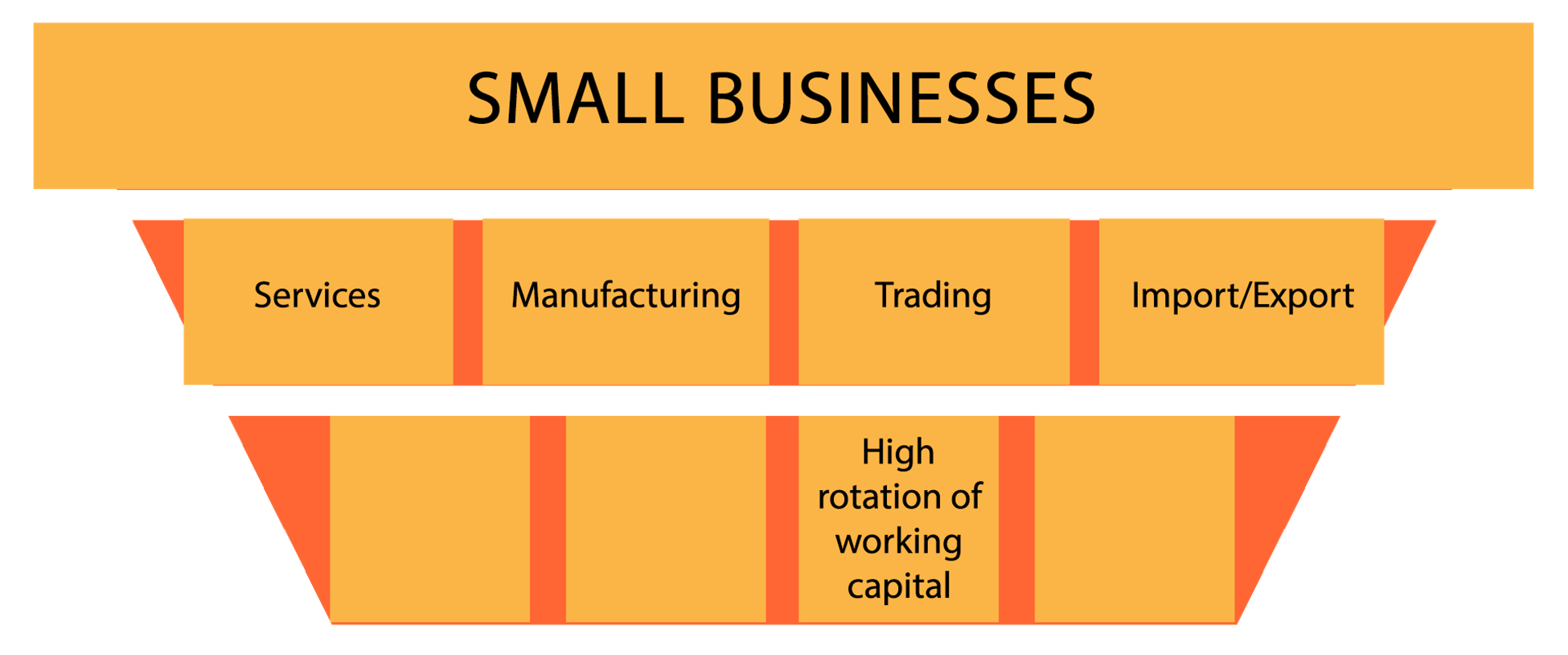

That means starting with a broad category and gradually narrowing it down through experimentation. The initial phase might involve engaging with various segments, such as traders, manufacturers, and service providers, before honing in on the specific target audience.

The initial experimentation phase is crucial. It’s a period where a startup may explore multiple segments, learning and adapting along the way. They generally experiment with different business types and move from a broad definition of the ICP to a more precise and targeted one. The journey is an evolutionary process—a strategic refinement that aligns the startup’s offerings with the specific needs of its chosen audience.

How is finding the ICP different for B2B vs B2C businesses?

B2C businesses like DoorDash or Airbnb are built by college students who have landed on a problem through their own experiences. This could be something as simple as dissatisfaction with food delivery services or the need for a more efficient social network. In these kinds of situations, domain knowledge often takes a back seat.

The emphasis is on identifying a problem and ICP accurately.

On the contrary, in B2B, the founder’s background and domain expertise naturally guide them toward broader problems within their industry. This expertise or insight often stems from a deep understanding of the industry, recognizing a significant problem that demands a solution. This, in turn, leads to a systematic narrowing down process as they strive to define the ideal customer profile.

But whether it is a B2B or a B2C business, the founder’s strategic strength lies in the ability to refine this broad definition over time. Smart founders employ an iterative process of experimentation and learning to narrow down the ICP, identifying specific segments within the broad definition that resonate more deeply with the problem at hand.

What’s the difference between the ICP and a customer segment?

Some startups define their ICP merely based on the size of the company, labeling it as SMB (Small and Medium-sized Businesses). However, the size of the company constitutes a segment, not an ideal customer profile.

ICP can be looked at as having different layers, from determining which type of organization is the perfect customer to honing in on the specific individual within that organization who holds decision-making power.

For example, you can start with a broad-level ICP like “SMB”. Within SMB, depending on your company, you could focus on traders, and within traders, distinctions can be made based on factors like business type, such as commodity trading or manufacturing.

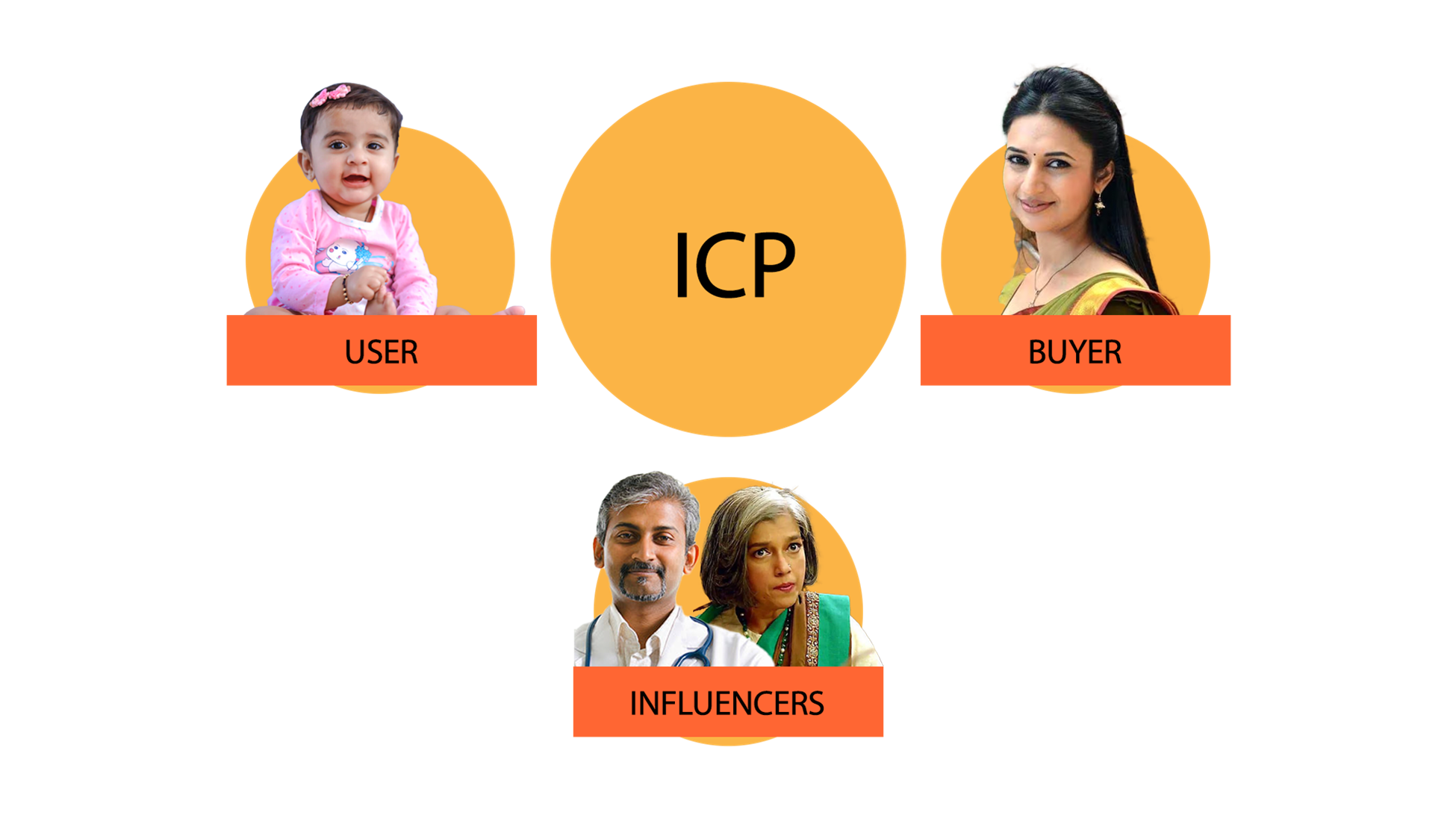

Your ICP is usually not just one person. There are usually three kinds of people you need to look at.

The buyer is the one who pays for the product, seeking economic benefits.

The user experiences the product and plays a pivotal role in its success.

The influencer sways the buyer’s decision-making process.

As an analogy to explain this easier, if your product is baby food, the buyer is the parent, the user is the baby, and the influencer is the pediatrician or even family members like the grandma.

It is very important to have all three of these people in mind while you zero in on your ICP. A cautionary tale of ignoring the user and the influencer is BYJU’S, the ed-tech giant that has been in the news recently for unsavory reasons. While they aggressively targeted the buyers (parents), they ignored the users (students) and even antagonized the influencers (teachers).

This is probably one of the major reasons that led to the company’s downfall in the renewal cycles.

How did Numberz find its perfect ICP?

In the initial days, the Numberz team focussed on trading and services communities—two segments that usually face cash flow challenges. Once the customer segment was identified, they started to narrow down. They made efforts to understand why these segments faced cash flow challenges.

After some research, they realized that while some companies faced these challenges because of external industry practices, others had cash flow problems because of internal processes. That’s when they figured out what their ICP was—companies with large invoices that had problems with internal processes.

Then, they focussed on figuring out how to categorize potential customers to find out which one to chase after. They used firmographic parameters like revenue range, employee count, and accounting software in use. But beyond the firmographics, they also focussed on psychographic parameters, like growth rates, other software usage within the company, and whether the business catered to significant buyers.

This iterative process of refining ICP components, often done every three to six months, allowed Numberz to align its solution with the evolving needs and characteristics of the target audience.

Box vs. Dropbox: A Case Study

Box and Dropbox are both companies that offer cloud storage solutions, and both companies have effective founders and successful trajectories. So it feels natural to club them both in the same bucket.

But if you dig a little deeper, you understand that while Box targets enterprises, Dropbox caters to the freemium or SMB space. This means the inner workings of both companies are different, and they have different cash flow mechanisms. Understanding this difference will help you sell your accounting solutions to both of these companies more effectively.

This is where the product team comes in—by providing this nuanced information, they allow the marketing team to craft messages that resonate specifically with each target audience. This collaboration ensures that marketing efforts are not just broad strokes but rather precision strikes.

Making these precision strikes also saves you a lot of money by directly advertising to your customers—instead of carpet bombing ads on a TV channel which can be very expensive, you specifically target places where your ICP might frequent and have more chances of seeing your ad.

The clarity you get through a well-defined ICP should bleed through every aspect of your business. From product development and marketing to sales and customer support, the ICP serves as a guiding light.

Acquisitions!

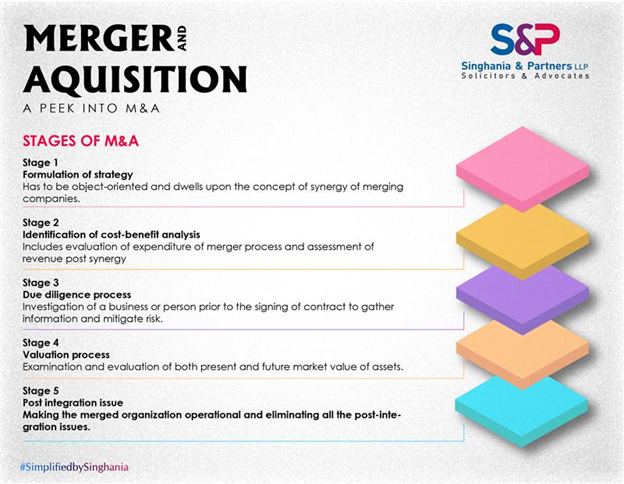

Successful Mergers and Acquisitions (M&A) are not spontaneous decisions but are rather built on strong relationships that evolve over time. It requires patience, trust-building, and continuous nurturing of relationships, especially if the founder is planning an exit strategy.

Trust isn’t established overnight; it’s cultivated through shared experiences, collaboration, and delivering value. It’s not only a prerequisite for M&A but is also a fundamental element required for sustained success in any business relationship.

Apart from nurturing the relationship with the buyer, good founders possess a unique ability to navigate both M&A discussions and internally drive product strategy, marketing, and operational milestones for the company. This requires compartmentalization, allowing founders to keep strategic discussions separate from daily operations. At some point, you’ll have to involve your management teams in these discussions.

This introduces a new set of challenges for the company. Management teams, not having the same level of personal connection to the company as founders, might question the ongoing efforts in areas like product development or marketing if there are even small signs of uncertainty. This divergence of focus can impact team morale and productivity.

But the important thing to keep in mind is while the M&A discussions are going on, the business metrics cannot dip. Even if the strategic acquisitions are going on as planned, if there’s a drop in the business performance of the company, it could derail the entire M&A process.

Involve your team gradually, start with only one or two people in the team and address their doubts and questions while being as transparent as possible about the whole scenario. It is important to alleviate fears and doubts that your upper-level management might have, and then slowly involve more and more people with the same kinds of conversations.

It is okay to not have all the answers to the questions that might come up, but it is important to be transparent about it since these answers come up slowly as the transition happens.

It is also important for the team to realize that business continuity and growth are paramount; you have to get to a stage where if the deal doesn’t happen, the team shouldn’t think that the business isn’t doing well.

Last Words of Wisdom from Aditya

“Your startup is NOT like your child, it is more like your first house.” If you have a child, you’d never part with your child (sell your company). A first house, even though you’ve put a lot of blood and sweat into it, will inevitably be sold. This perspective shift helps you think about M&A more strategically and less emotionally.